When salary negotiations turn sour, the fallout can affect both employers and job seekers deeply. In a world where compensation talks can make or break job offers, understanding the salary negotiation disconnect is crucial for both parties. This blog explores the complex dynamics of salary negotiations, shedding light on the common misunderstandings and tactical errors that often lead to frustrating outcomes. By diving into the perspectives of both employers and job seekers, we aim to demystify the process and provide actionable advice to help navigate these critical discussions more effectively. Whether you’re offering a job or accepting one, understanding these nuances could be the key to a successful negotiation that satisfies both parties.

Why Do Salary Negotiations Fail?

Salary negotiations can be a tightrope walk for both employers and job seekers. Recognizing where these disconnects occur is the first step to better negotiations:

Common Pitfalls in Salary Negotiations

Salary negotiations often stumble because of common misunderstandings and miscommunications. For both employers and job seekers, recognizing these pitfalls can pave the way for more successful outcomes.

Employers: The Importance of Transparency

Employers need to approach salary negotiations with openness about the rationale behind their offers. A common pitfall is failing to provide a clear explanation of how salaries are structured and what factors influence the final figures. This includes market rates, the candidate’s experience level, and internal parity. By being transparent, employers help mitigate the salary negotiation disconnect by setting clear expectations and building trust with potential hires. Moreover, embracing pay transparency can lead to reduced wage gaps and foster a more equitable workplace, as noted by PayAnalytics. Companies that are upfront about their pay structures are often seen as more ethical and employee-friendly, which can attract top talent and reduce turnover rates, according to Forbes.

Job Seekers: Knowledge Is Power

For job seekers, a frequent stumbling block is entering negotiations without a solid understanding of their market worth or the typical salary ranges for the position in their geographic and professional area. This lack of preparation can lead to unrealistic salary expectations or the inability to effectively articulate their value. Job seekers should arm themselves with up-to-date salary data and be prepared to discuss how their background and achievements align with the demands of the role.

Bridging the Gap: Facilitating Balanced Discussions

To bridge the salary negotiation disconnect, both parties must aim for an open and respectful negotiation process. Employers should be prepared to discuss the full compensation package clearly, while job seekers should transparently share their salary expectations and justifications. Employing tools like salary calculators and accessing up-to-date salary data can facilitate a more informed discussion, helping both sides achieve a mutually beneficial agreement.

Addressing these common pitfalls can significantly smooth the process of salary negotiations, reducing misunderstandings and fostering a more productive dialogue between employers and job seekers.

Equity Concerns in Salary Discussions

Equity is a critical aspect of salary negotiations that can significantly impact the perceptions and outcomes of these discussions. Understanding how to approach equity can help both employers and job seekers navigate this complex topic effectively.

Employers: Balancing Internal and External Equity

For employers, it's crucial to balance internal equity—ensuring that employees in similar positions with similar experience and performance are paid comparably—without alienating potential new hires by offering less competitive salaries. Employers need to be transparent about how salaries are determined and aware that internal pay structures might not always align with current market rates. Ignoring market competitiveness can exacerbate the salary negotiation disconnect, especially when a candidate is aware of their market value.

As highlighted by AIHR, maintaining internal equity is essential for employee morale and retention. However, businesses must also recognize that their internal equity concerns are not the external candidate's problem. According to this LinkedIn article by Robert J. Greene, companies risk losing both external candidates and their own internal talent to competitors if they fail to stay competitive with external market values. If employees realize they are underpaid compared to the market, they are likely to leave regardless of internal equity efforts. Thus, businesses need to enhance internal equity while also ensuring they offer competitive salaries aligned with the external market to attract and retain top talent effectively.

Job Seekers: Understanding When to Discuss Equity

Job seekers should be prepared to discuss equity concerns, but timing is key. It's advisable to bring up equity questions after receiving a job offer, when there is a clear intent to hire and room to negotiate. They should seek to understand how their potential salary compares with others within the same organization and the criteria for future salary adjustments and promotions. This understanding can help mitigate the salary negotiation disconnect by setting realistic expectations.

Bridging the Gap: Transparent Conversations About Equity

To bridge the salary negotiation disconnect regarding equity, both parties should engage in open and honest discussions about how salaries are structured within the organization. Employers can provide prospective hires with a clear understanding of the compensation philosophy and growth opportunities, while job seekers should feel empowered to ask for a fair comparison to ensure they are being offered a competitive and equitable package. Both parties can benefit from such transparency, which promotes fairness and satisfaction in the hiring process.

Understanding Total Compensation Beyond Salary

When discussing compensation, it's crucial to look beyond the base salary to understand the full package being offered. This holistic view helps mitigate the salary negotiation disconnect by aligning expectations between employers and job seekers.

Employers: Offering a Comprehensive Package

Employers must articulate the total compensation package clearly, highlighting elements like benefits, bonuses, and growth opportunities. This approach helps justify the salary offered and shows the employer’s commitment to their employees' comprehensive well-being. Benefits such as health insurance, retirement plans, paid leave, and professional development contributions often add substantial value that may not be immediately obvious when looking at salary alone. By fully presenting these elements, employers can demonstrate a deeper level of investment in their workforce.

Additionally, in our 2024 top recruiting trends report, it's clear that candidates increasingly value remote and flexible work opportunities alongside purpose-driven work. Working for a purpose-driven company can significantly enhance job satisfaction and retention. By offering a comprehensive package that includes flexible work options and aligns with these values, employers can attract top talent and foster a motivated and committed workforce.

Job Seekers: Evaluating the Complete Offer

Job seekers should assess an offer in its entirety, not just the salary. This evaluation should include health benefits, retirement plans, paid time off, and opportunities for professional growth. These components can significantly enhance the total value of the offer, sometimes compensating for a lower-than-expected salary. Understanding the full package allows candidates to make informed decisions based on the complete value of what’s being offered, rather than salary alone. Additionally, Deloitte emphasizes the importance of evaluating the professional growth opportunities within organizations. Access to training, career development programs, and advancement opportunities can add significant value to a job offer.

Bridging the Gap: Communicating Total Compensation

To effectively address the salary negotiation disconnect, it is crucial for both parties to communicate openly about all components of the compensation package. Employers should be transparent and detailed, while job seekers should feel empowered to ask clarifying questions, so that they can better understand the holistic value of a job offer and make more informed decisions. This comprehensive understanding can shift negotiations from mere salary discussions to a broader conversation about mutual benefits and shared value, leading to more successful outcomes.

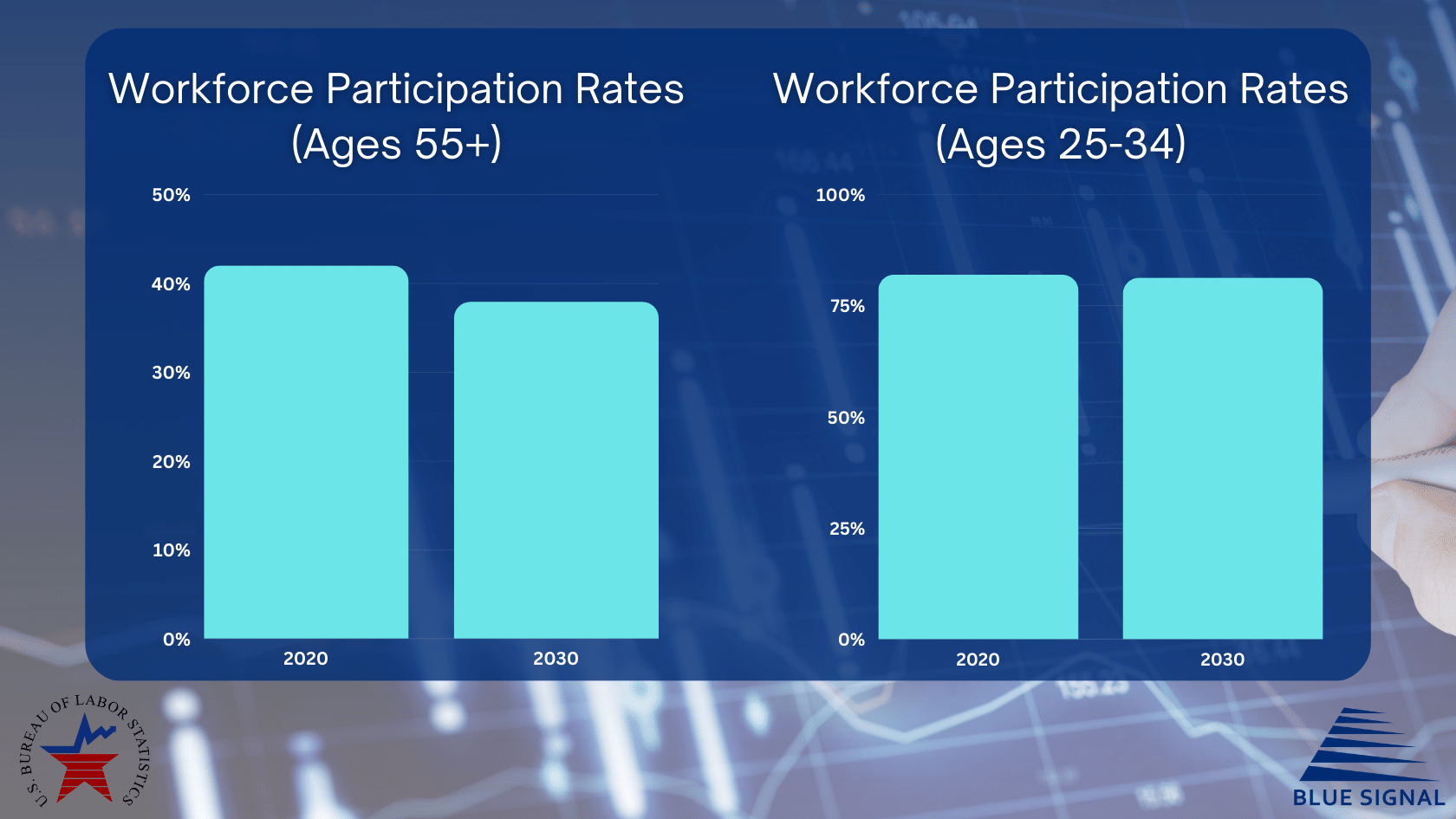

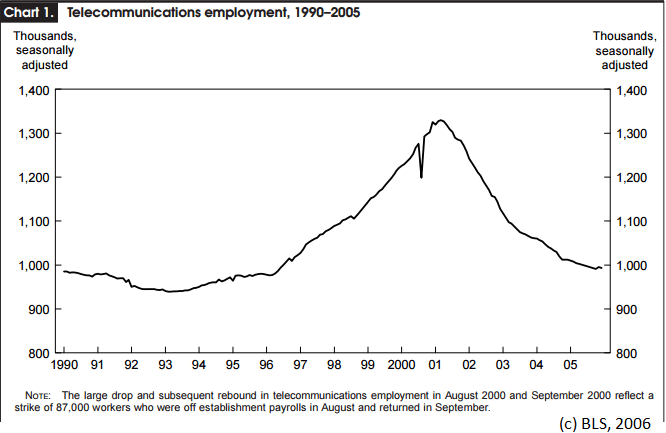

Economic Trends and Their Impact on Salary

As economies fluctuate, the landscape of salary negotiations shifts accordingly, presenting unique challenges and opportunities for both employers and job seekers. Understanding these economic trends is pivotal in navigating the often-complex salary negotiation disconnect, ensuring that both parties engage in informed and fair discussions.

Employers: Adapting Offer Strategies to Economic Shifts

In an environment influenced by economic shifts, such as inflation or recession, employers must adjust their salary offers to remain competitive and realistic. Understanding the economic context is essential for making offers that are attractive yet sustainable. During times of inflation, for example, salary offers should reflect the higher cost of living to prevent them from being perceived as undervalued by potential hires. According to Payscale, staying informed about industry salary benchmarks and economic forecasts is crucial for guiding compensation strategies. Additionally, WorldatWork projects that pay increases in 2024 are expected to exceed inflation, highlighting the importance of aligning salary offers with economic realities to effectively address the salary negotiation disconnect.

Job Seekers: Negotiating with Economic Awareness

Job seekers need to be aware of the broader economic conditions when negotiating salaries. In times of economic downturn, for instance, understanding the pressures on businesses can guide seekers in making reasonable demands. Conversely, in a booming economy, candidates might leverage their skills for better offers. Being informed about the economic climate helps job seekers approach negotiations with a balanced perspective, aligning their salary expectations with current market realities.

Bridging the Gap: Flexible and Informed Negotiations

Both employers and job seekers benefit from maintaining flexibility and staying informed about economic trends that impact salary structures. By fostering open discussions about how economic factors influence salary offers, both parties can negotiate more effectively, ensuring fair and equitable salary agreements that reflect both current economic conditions and individual value. This mutual understanding can significantly reduce the salary negotiation disconnect, leading to more successful and satisfactory hiring outcomes.

Partnering with Blue Signal Search

Navigating the complexities of salary negotiation can be challenging, but it doesn't have to be a struggle. At Blue Signal Search, we specialize in smoothing over these disconnects, providing expert guidance to ensure both parties reach mutually beneficial agreements. While we understand that some employers may face budget constraints, we excel in helping you present a fulfilling job offer that attracts top talent. Our recruiters work closely with employers to craft compelling compensation packages that align with market trends and organizational goals, while also offering strategic advice to job seekers to help them articulate their value effectively.

For job seekers looking to sharpen their negotiation skills, our sister company, Resume and Career Services, offers invaluable resources. Their YouTube channel features free video courses on salary negotiation tactics, equipping you with the knowledge needed to secure a fair and satisfying job offer. By partnering with our team, you gain access to a holistic approach to recruitment that simplifies the negotiation process, ensuring successful outcomes for all involved.

Conclusion

In conclusion, navigating salary negotiations can be tricky, often leading to a salary negotiation disconnect that results in misunderstandings and missed opportunities. But with clear communication, realistic expectations, and a bit of empathy, employers and job seekers can bridge the gap and turn potential conflicts into win-win situations. Use this guide to approach your next negotiation with confidence and share these insights with your network to help others navigate the process. And remember, if you ever need expert guidance, reach out to myself or any of our team at Blue Signal Search. We're here to help you transform daunting negotiations into opportunities for growth and success!

Meet Recruiting Expert, Kelsey Campion

Kelsey Campion, Sr. Recruiting Manager at Blue Signal Search, brings a wealth of experience and expertise to the table. With a proven track record in connecting top-tier talent with industry-leading employers, Kelsey is dedicated to helping businesses navigate the complexities of hiring and salary negotiations. Her strategic approach and deep understanding of market trends ensure that clients receive tailored solutions to meet their unique hiring needs. Whether you're looking to fill a critical role or build a high-performing team, Kelsey Campion is your go-to partner for recruitment success. Contact Kelsey to see how she can help support your hiring goals!

Partner with us for your next hire.

Set up a free consultation with a recruiting manager. Tell us about your hiring need.

By submitting this form, you consent to receive communications from Blue Signal, including phone calls, emails, and text messages.