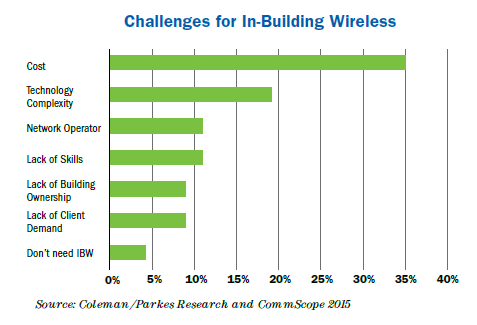

A recent industry survey by Coleman Parkes found that properties with excellent in-building wireless coverage technology were worth 28% more than properties with poor indoor coverage. The demand for reliable in-building wireless continues to grow. Many older buildings are constructed from materials that block cell signals and create pain points for building tenants. Even buildings with cellular coverage often lack capacity for today’s normal mobile usage. However, building owners have been reluctant to upgrade because of the perception that a DAS infrastructure investment is too costly. This year, that is changing. High-quality DAS solutions are becoming available for mid-sized businesses.

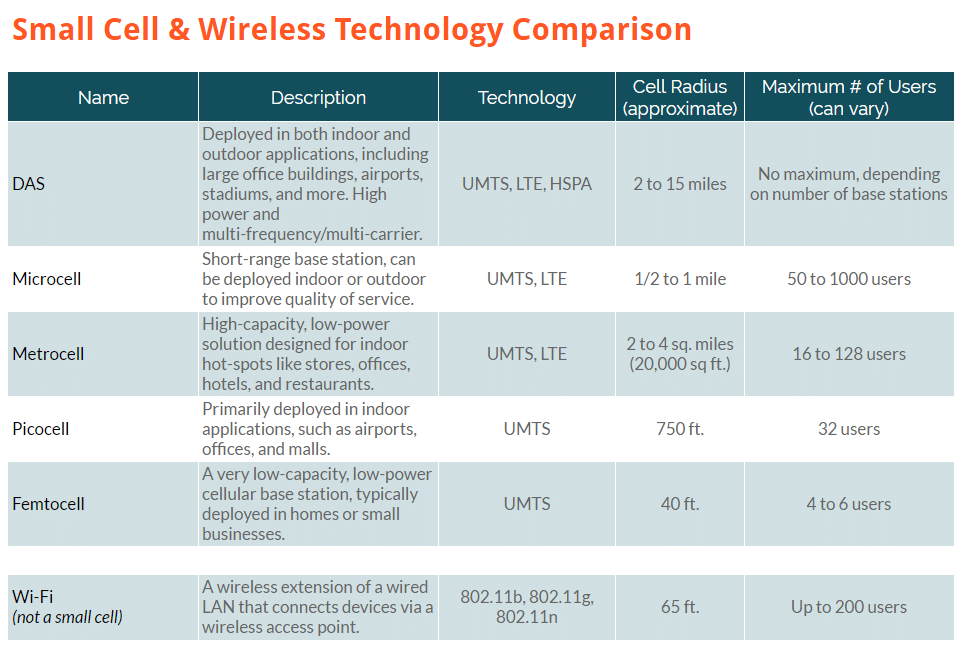

Wireless companies are competing heavily for businesses in the “middleprise” sector: venues between 50,000 and 500,000 square feet. While DAS is the default coverage solution for big venues like stadiums, airports, and large enterprises, a full-scale DAS is not usually cost-effective for midsize venues like hotels, malls, and hospitals. They are big enough to need an in-building coverage solution to boost the indoor signal, because poor coverage affects employee performance, productivity, and even the rent that the building owner can charge. However, traditional DAS solutions are often too large and expensive for these venues. WiFi coverage alone is not enough to deal with high data volume, and VoWiFi is not reliable enough for mission-critical telecommunications.

These midsize enterprises sometimes balk at pulling the trigger on a major DAS installation because of price or complexity. Since many companies have a BYOD policy, their connectivity solution needs to support bandwidth-intensive, multi-operator, multi-band functionality. At the same time, it needs to be cost-effective, secure, easy to manage, and somewhat future-proof.

Multi-operator Small Cells

Middleprise businesses have traditionally avoided small cells because of their limitation to a single carrier. Installing separate small cells for each carrier looks bulky and is unappealing from a design perspective. At this year’s Mobile World Congress, Baicells introduced their NeutralCell product, a multi-operator small cell technology that promises to eliminate this obstacle.

Shared infrastructure models are gaining traction fast. Today’s mobile user expects uninterrupted coverage, no dropped calls, high bandwidth, and high data speeds. However, MNOs cannot build their networks into every single building. Since building owners often have their own ideas about how much space they want to dedicate to network equipment, NeutralCell, SUMO, and similar emerging technologies will bridge this gap so that midsize venues can improve in-building coverage for all carriers for a competitive price.

Signal Boosters & Passive DAS

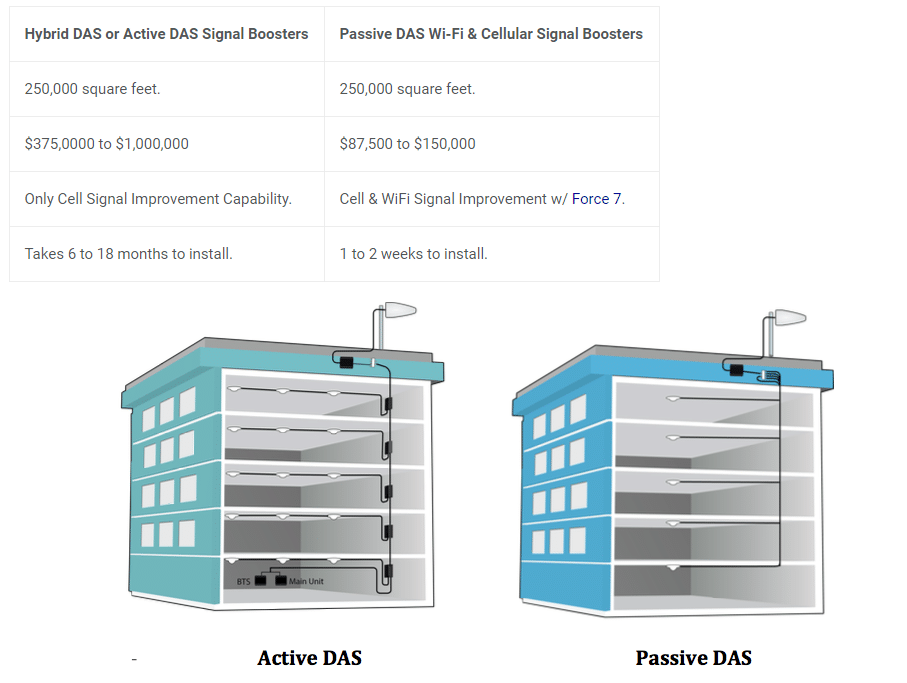

One hybrid option that many enterprises will likely opt for in 2018 is a signal booster. While most people are familiar with indoor residential signal boosters, signal boosters in a passive DAS context are new to many enterprise owners. This option works very well for building managers who are struggling with poor indoor cell service, dropped calls, or inconsistent coverage. Passive DAS is a large-scale but simple signal booster that quickly improves coverage without complicated management.

The market often uses the term “DAS” to describe an active DAS system. But a DAS is by definition a distributed antenna system, and therefore both active and passive systems qualify as true DAS. Active DAS transmits signals through fiber cables and can boost and amplify signals as needed. Passive DAS transmits uses a leaky feeder communication system consisting of a coaxial cable that functions like an antenna, with “leaks” all along the length of the cable to allow radio signals to enter the cable along its length.

Since passive DAS costs about six times less than an active DAS system, many smaller enterprises choose it over the top-of-the-line solutions. In addition to the lower price, many enterprises prefer the shorter installation time of passive DAS (1 to 2 weeks). An active DAS can take 6 to 18 months to design and install.

5G and IoT-Friendly Network Design

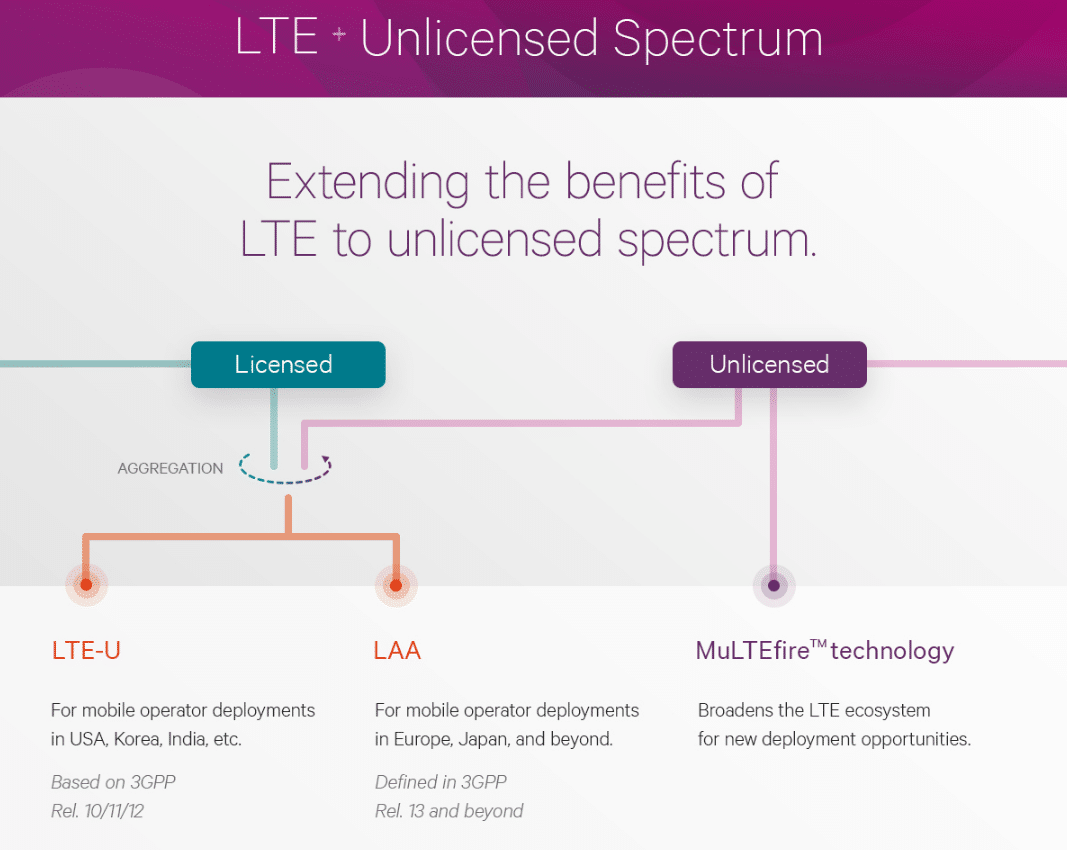

The long-awaited 5G network infrastructure is starting to be switched on in parts of Europe, with America soon to follow. While the carriers themselves will be handling the physical wireless infrastructure 5G, many owners of large and midsize venues are considering timing their upgrades to coincide with new network technology and faster speeds.

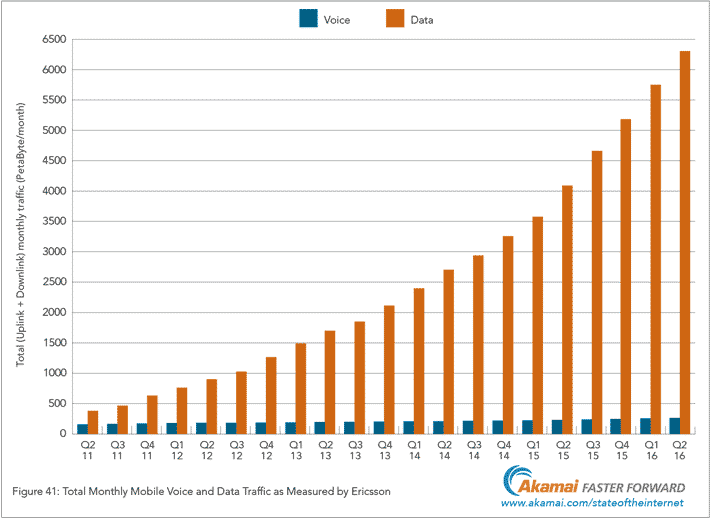

Additionally, the number of IoT devices has ballooned to almost 9 billion devices worldwide, and is expected to hit between 10 and 15 billion devices by the end of 2018. The IoT landscape is a very strong incentive for building owners to consider DAS systems. Just 15 years ago, the vast majority of office equipment consisted of hard-linked computers, but today’s workplace depends on BYOD, consumer smart devices of all kinds, and IoT/M2M business equipment. This extra traffic puts pressure on the network. Additionally, middleprise building owners have a huge range of IoT devices customized to make their lives easier: smart utility meters, IoT-based security, smart traffic sensors, and more. The cost savings of smart building technology alone is sometimes big enough to offset the cost of a DAS or small cell solution.

Future Outlook

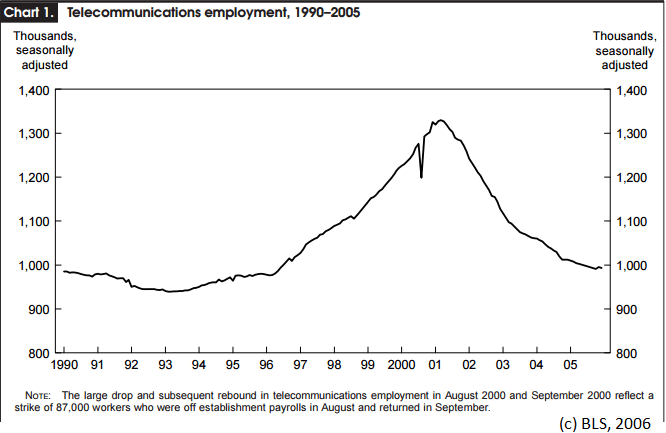

The most interesting aspect of the industry space outlook is the shifting relationship between enterprise customers and MNOs. It used to be that enterprise customers were completely dependent on the MNO to build network infrastructure to improve their connectivity and capacity. This model is still true for the individual cell phone user. But enterprise customers are experiencing such heavy demand pressure that they are no longer waiting around for the MNOs to expand the network equipment to meet their needs.

Learn more about our DAS and small cell recruiting specialties here.