The CHIPS Act stands as a landmark decision, poised to redefine the technological and manufacturing prowess of the United States. This legislation is not just about boosting semiconductor production; it's a comprehensive strategy to strengthen supply chains, enhance global competitiveness, and secure technological leadership. The ripple effects of this act promise to touch every corner of the tech, manufacturing, and telecom industries, catalyzing growth and innovation. As these sectors gear up for an influx of development and demand, the act also touts a transformative phase for recruitment and hiring, presenting a unique set of challenges and opportunities that demand strategic foresight.

Introducing the CHIPS Act

What is the CHIPS Act and What Does it Aim to Achieve?

The CHIPS Act, short for Creating Helpful Incentives to Produce Semiconductors for America, is a strategic initiative by the U.S. government to bolster semiconductor manufacturing and reduce dependence on foreign chip production. It's a direct countermeasure to recent global shortages and a step towards reinforcing national security and economic stability. By fostering domestic innovation and production, the act also aims to catalyze job creation and secure the United States' position in the global tech race. The legislation is expected to trigger a wave of advancements in semiconductor technology, ensuring the U.S. remains at the forefront of this critical industry.

How Will the CHIPS Act's Financial Incentives Impact Industries?

Allocating over $50 billion in federal funding, the CHIPS Act aims to invigorate every facet of the semiconductor industry, from research and development to workforce training, ensuring a sustainable and innovative future for American technology. These financial incentives are designed to stimulate private sector investment, creating a multiplier effect that could significantly expand the industries’ capacity and capabilities. The funding is a beacon of hope for startups and established firms alike, promising to bridge the gap between pioneering research and market-ready technologies.

The Far-Reaching Impact of the CHIPS Act Across Industries

What Role Will the CHIPS Act Play in Enhancing Wireless & Telecom?

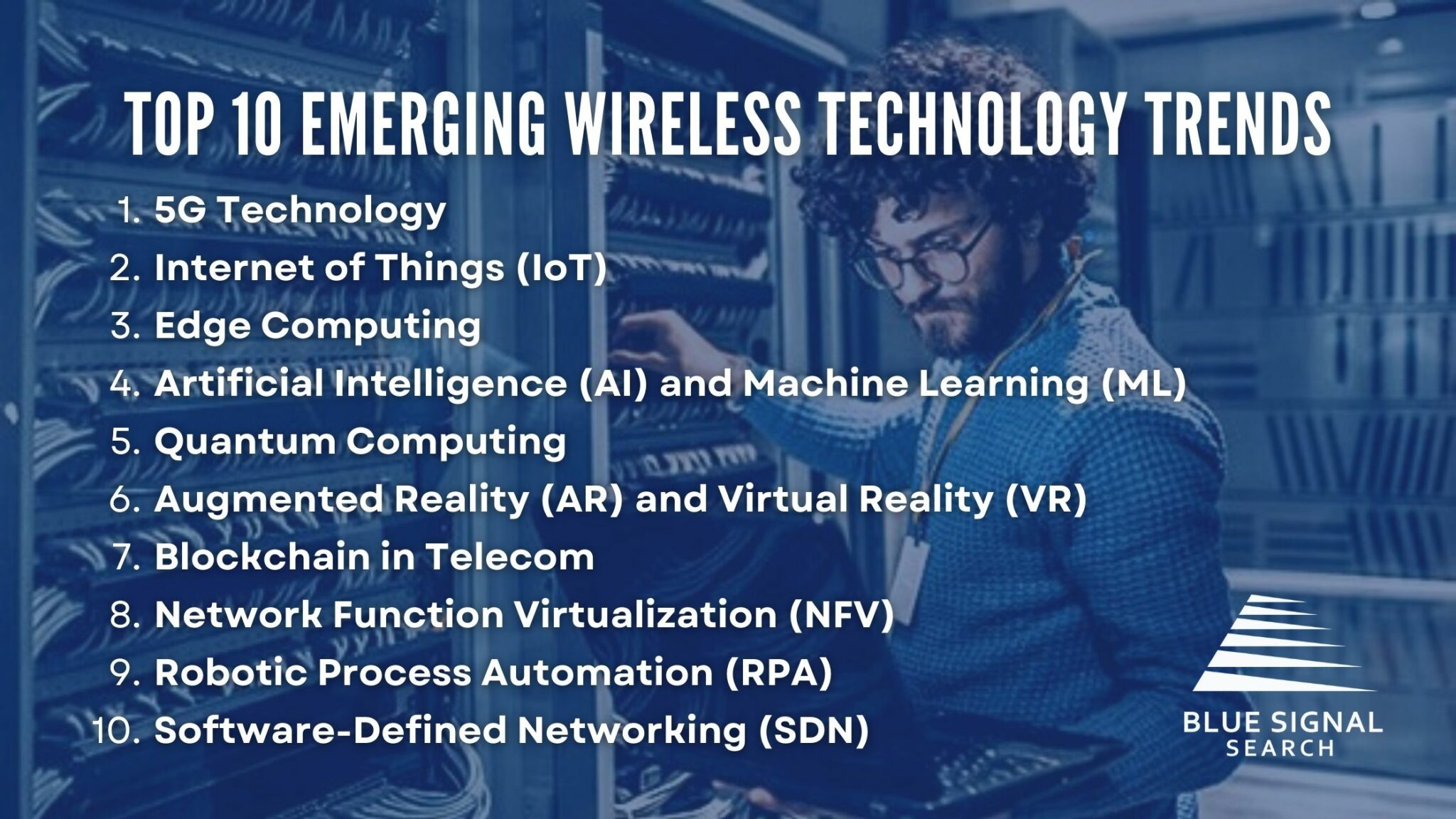

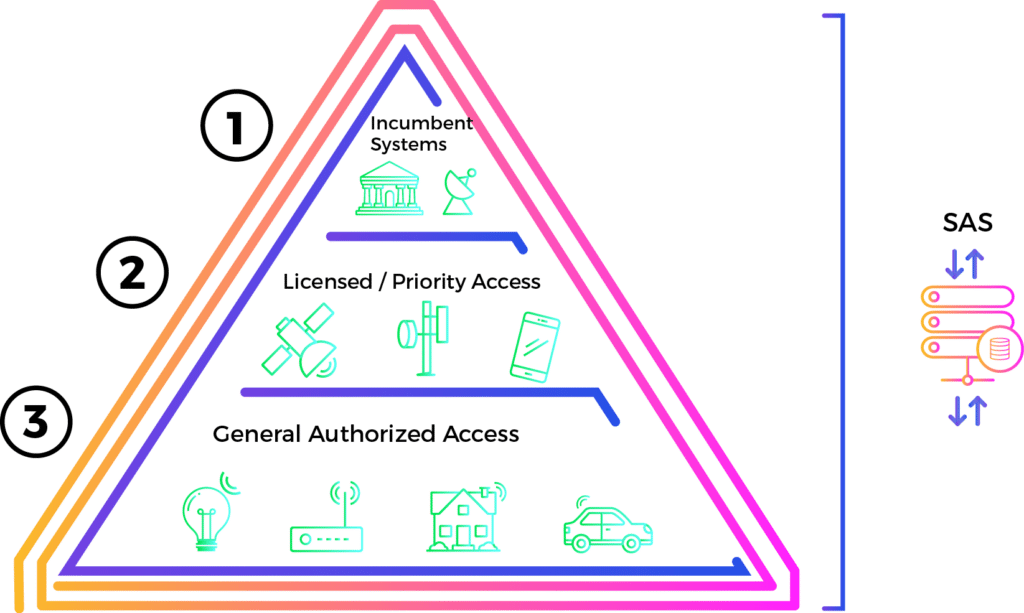

The act is expected to significantly bolster the wireless and telecom sectors by ensuring a reliable supply of semiconductors, which are crucial for the infrastructure of modern communications, from 5G networks to consumer devices. With an enhanced semiconductor supply chain, companies in these sectors can expect to see reduced costs and improved efficiencies, leading to more innovative services and products for consumers. The CHIPS Act is also likely to drive advancements in IoT and smart technologies, further solidifying the U.S. as a leader in wireless and telecom innovation.

How Can Construction and Broadband Expect to Grow with the CHIPS Act?

The CHIPS Act's investments are likely to accelerate growth in construction and broadband as well, which are essential for building a more interconnected and technologically equipped society. The construction industry, in particular, stands to benefit from the increased demand for state-of-the-art facilities required to house semiconductor manufacturing operations. Moreover, the expansion of broadband infrastructure, supported by the act, will enable more communities to participate in the digital economy, unlocking new opportunities for growth and development.

In What Ways Will Manufacturing Undergo a Tech-Driven Renaissance?

The manufacturing sector is on the cusp of a renaissance, with the CHIPS Act serving as a springboard for the creation of advanced manufacturing roles and a revival of American industrial might, signaling a new era of tech-infused production. This renaissance will likely usher in a new age of digital manufacturing, where automation and data-driven technologies play a central role in production processes. As a result, the act will not only revitalize manufacturing but also elevate the industry to new heights of innovation and efficiency.

Navigating the Hiring Landscape in the Wake of the CHIPS Act

What Job Creation Opportunities Does the CHIPS Act Present?

The CHIPS Act is projected to generate a wide array of job opportunities, spanning from specialized engineers to support personnel, reshaping the hiring landscape and amplifying the need for a skilled workforce. This surge in job creation will demand a workforce equipped with cutting-edge skills and knowledge in semiconductor technologies and manufacturing processes. As the industry expands, the act will also encourage the development of ancillary businesses and services, further diversifying the job market and providing new career pathways.

How Will Talent Acquisition Evolve with the CHIPS Act's Implementation?

The surge in demand for skilled professionals will intensify the competition for top talent. Companies will need to refine their talent acquisition strategies to attract and retain the best in the field, making partnerships with seasoned recruiters more crucial than ever. In this evolving landscape, recruiters will need to be more proactive and innovative in their approach, leveraging new tools and platforms to connect with a broader talent pool and meet the specific needs of the semiconductor industry.

Why is Blue Signal the Recruitment Partner of Choice in the CHIPS Act Era?

With deep-rooted expertise and an expansive talent network, Blue Signal is uniquely positioned to help companies navigate the complex hiring landscape shaped by the CHIPS Act. Our industry insight and recruitment acumen make us the go-to partner for firms looking to harness the act's full potential. Blue Signal's tailored approach to recruitment, which encompasses a deep understanding of the tech and manufacturing sectors, positions us as a strategic ally in building a robust workforce for the future.

Conclusion

The CHIPS Act is set to be a transformative force, reshaping the landscape of American industry and innovation. As it unfolds, its profound impact on recruitment and hiring will become increasingly evident. Blue Signal stands ready to guide companies through this new era of talent acquisition, ensuring they are well-equipped to meet the challenges and seize the opportunities presented by the CHIPS Act.