The initial boom of the lighting industry began with fluorescent lighting in the 1930s and 40s. Since then, the lighting industry has expanded and transitioned into a much higher technical and innovative field. LEDs dominated the lighting industry in 2020, sweeping 61% of the global lighting market. According to Mordor Intelligence, the LED lighting market was valued at $75.81 billion last year and is projected to grow to $160.3 billion by 2026.

Seasoned by 80+ years of evolvement, the lighting industry continues to innovate and expand market reach across almost every industry you can name. Lighting is in everything, everywhere, and affects everyone in all aspects of our daily routines. As we’ve come to rely on and expect this advanced technology, it’s often easier to overlook this market as one of the driving forces of innovation. One of the key advancements we’re seeing in the lighting industry is its entrance into the digital world. The lighting industry is stepping into the spotlight across the technology industry. Key companies and manufacturers are taking advantage of the use of lighting; digitally, wirelessly, and sustainably. The lighting industry as a whole is moving beyond its traditional purpose of illumination and adding value to tangible aspects of our, technologically advanced, new world.

Technology that will Shape the Future:

Augmented Reality (AR) & Virtual Reality (VR)

In the near term, the global AR/VR market is expected to grow by $125 billion in the period from 2020‒2024, according to research firm Technavio. As our digital world continues to advance into further capabilities of augmented and virtual realities, the lighting industry will evolve simultaneously. Beyond video gaming and entertainment use cases, virtual reality (VR) is on track to be utilized across a wide range of industries – vastly impacting the way we do business. For example, a lighting designer could sit down with a potential client and physically show how various lighting options would look like at a job site through augmented reality.

This same concept would be transferable across all industries and increase efficiency – leading to less waste, less downtime, and less confusion when delivering a product or service. To advance to this space, technology will need to continue to advance within the lighting industry. Innovations such as liquid-crystal displays (LCDs), digital light processing (DLP), and liquid-crystal-on-silicon (LCoS) lighting have built a strong foundation but individually lack in certain areas. The jury is still out on which innovative solution is to come, but the advancement is inevitable.

Machine Learning (ML)

As we venture into the possibilities of creating fully virtual worlds, lighting technologies are bound to play a major role in the way we create a life-like experience using imagery. But before that can come to fruition, data collection and machine learning (ML) will set the stage. The lighting industry will rely on this technology to further advance products through the collection of learned data and routines. The data collected by an all-digital lighting infrastructure is essential for diagnostics and root-cause analysis. The ability to detect and minimize premature wear out or system failures becomes essential when implementing lighting technology into critical devices – such as those in the healthcare industry. Further, the ability to digitally learn patterns and routines within homes and businesses will increase sustainability and cost-saving features by conserving energy during downtime.

Internet of Things (IoT)

In today’s day and age, we rely on the internet to be connected in most of our devices and throughout our daily routines. By no surprise, the Internet of Things (IoT) industry is booming with no sign of slowing down. This has made it a key player in the advancement in the lighting industry. Since lighting is used all around us, IoT enabled lighting advances the development of connected systems. This collaboration of two industries is further enabling smart buildings and devices we use in offices, businesses, and homes. Implementing IoT enabled LED lighting in every room of a building helps create smarter buildings and cities, enabling countless capabilities.

A particular market that is on the rise in the lighting industry is human-centric lighting (HCL). HCL is defined as light that mimics natural daylight throughout the hours of a day that in turn allows our bodies to function in their most natural and effective state. Human-centric lighting is among the key markets that are thought to be most effectively implemented with IoT compatible lighting. Further, we are seeing IoT compatible LED lighting as the powerhouse behind systems that innovate air conditioning and heating, power grid management, and even next-gen wireless communications.

Li-Fi

With the explosive advancements in 5G technology, Li-Fi is has become a key player in the cellular and internet space. As 5G connection ramps up and slowly becomes available, Li-Fi has been able to fill a gap in how efficiently we’re able to access information. Essentially, Li-Fi is the upgraded version of Wi-Fi internet connectivity using light rather than radio waves to transfer connection. With the functionality to transfer data at speeds up to one hundred times faster, it has opened up the unlimited capabilities the lighting industry has to offer. For example, having Li-Fi integrated into LED lighting would create an alternate path for internet connectivity in high traffic and functioning spaces such as commercial buildings such as airports and offices. By being able to transmit at multiple gigabits, being more reliable, virtually interference free, and uniquely more secure than radio technology such as Wi-Fi or cellular, Li-Fi is the key to a connected community.

Lighting Controls

The advancement of IoT and Li-Fi technology has enabled the lighting industry to develop innovated lighting controls. These controls allow for ease of use and functionality within lighting products. With smart lighting as the clear future of the lighting industry and products, these controls have become a vital piece in the inevitable adoption of Internet of Things (IoT) and other advancing technology. From these advancements, sensors and lighting automation have seen an influx in demand. By using integrated sensors and controls, no central control hardware or room-based sensors need to be wired. This allows for a faster installation and increased accessibility. It has now become simple for users to adjust settings, automate schedules, and utilize their lighting products from virtually anywhere by connecting through portable applications – no cables or wires required. On a larger scale, this capability allows for the collection of important information about the operation of structures or systems such as power grids and emergency generators. Allowing us to make more informed decisions and ensures safety precautions are in place and running smoothly at all times.

The Future of Hiring in the Lighting Industry:

As these technologies linked to the lighting industry continue to advance, what does this mean in terms of the industry’s job market? For clients, candidates, and recruiters alike it means honing in on key skill sets and niches that stand out. One of the top skills impacting the lighting industry involves controls implementation. This certain integration with other technologies is not an intuitive process and requires specific education that is not simply taught on the job. In today’s job market, electrical contractors can differentiate themselves by their ability as system integrators. In turn, recruiters can highlight these candidates and hiring managers can start their search for these candidates while the supply is still available. A working knowledge of the various protocols and best practices for integration will be critical for the foreseeable future.

Li-Fi is another key market that should be narrowed in on when sifting through candidate’s skills and knowledge. This new technology has momentum, products are available, and the limitations of 5G in interior spaces will further accelerate the value of Li-Fi in the marketplace. Electrical engineers that understand the implementation of data-flow solutions through Li-Fi-enabled fixtures will be vastly sought after in the lighting industry.

Lastly, COVID-19 has brought on an increased need for advanced technology within the healthcare industry. Niche market segments like ultraviolet disinfection products have increased in demand. Ultraviolet light has been used to sterilize and disinfect medical equipment for quite some time but lacked innovation as of recently. The global impact of the pandemic triggered researchers across the globe to develop an ultraviolet LED solution to disinfect and sterilize hospital beds, floors, and surfaces more thoroughly than ever before. This has become critical technology and with its new advancement, the lighting industry is predicted to build upon these innovations and further implement them across industries.

As we can see, lighting plays an integral role in essentially every market sector. Coupled with recent innovation in technology, the capabilities are endless. With the overall theme of emerging tech moving toward all-digital infrastructures, every new innovation in the lighting industry leads to a golden opportunity to lay the foundation for advancement. The global lighting industry is expected to grow to $163 billion by 2027, which has proven itself not to be a market to overlook. When navigating this exciting time in a growing sector, utilize the expertise of Blue Signal’s recruiters who are seasoned with over 15 years of experience hiring within the lighting industry. We are a trusted source with a firm understanding of what it takes to find qualified candidates – faster than the speed of light. Reach out to one of our specialized recruiters today and start illuminating the way to your perfect hire or dream job.

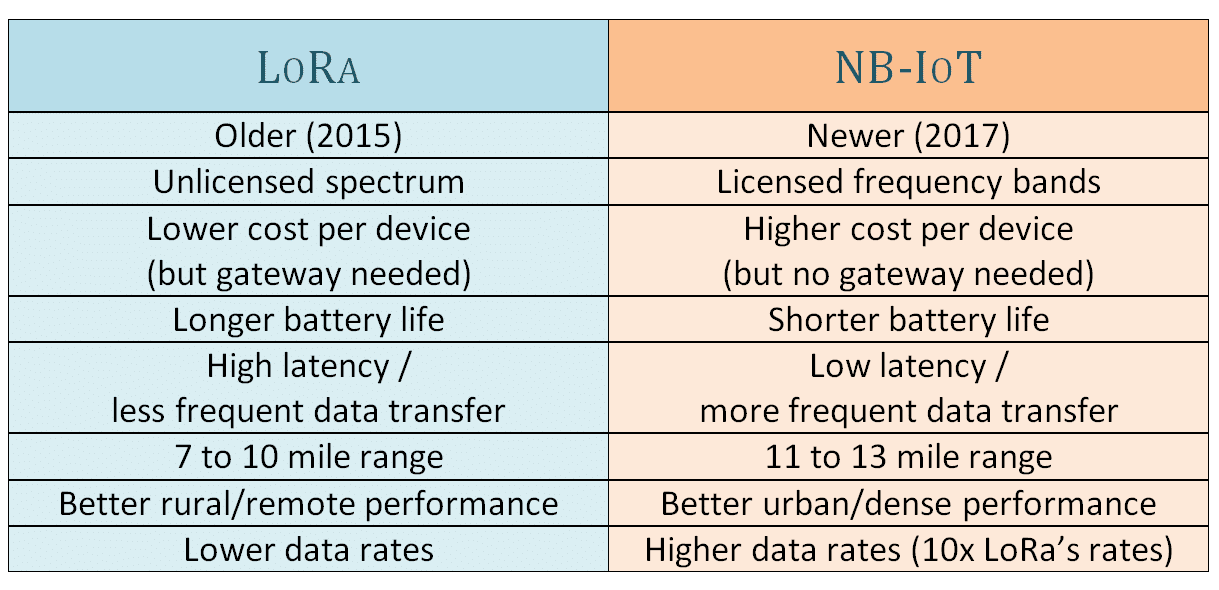

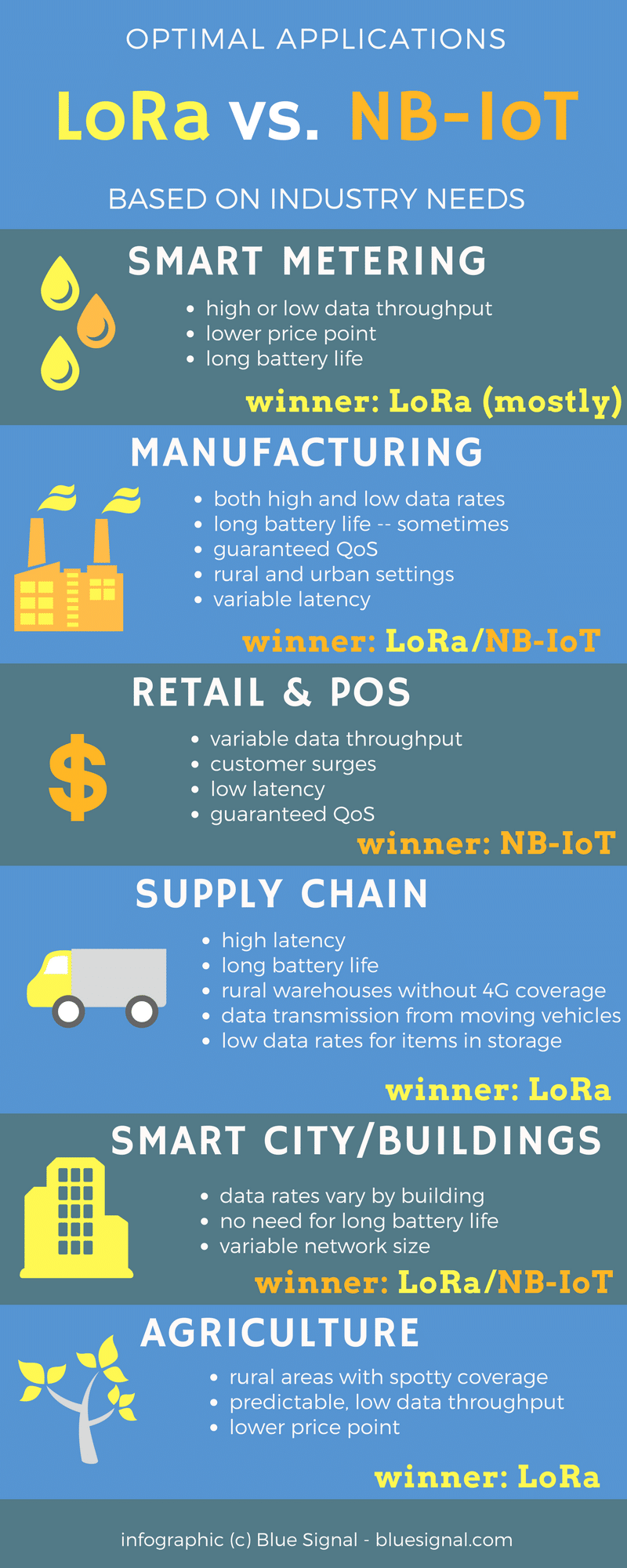

LPWAN stands for Low-Power Wide Area Network, a wireless network designed to efficiently connect smart devices across long distances, usually through a low bit rate. LPWANs are ideal for IoT devices that don’t need to manage large amounts of data, or for circumventing more expensive gateway technology. This can include smart meters, consumer products, and sensors. The overall value of the LPWAN market is expected to reach $25 billion within 4 years.

LPWAN stands for Low-Power Wide Area Network, a wireless network designed to efficiently connect smart devices across long distances, usually through a low bit rate. LPWANs are ideal for IoT devices that don’t need to manage large amounts of data, or for circumventing more expensive gateway technology. This can include smart meters, consumer products, and sensors. The overall value of the LPWAN market is expected to reach $25 billion within 4 years.