This year, the global accounting services market value is expected to reach $868 billion – and projected to grow by 6% by 2031. Due to the expansive growth, the industry is experiencing, competition in the accounting field is at an all-time high. To combat this curve, adding one or more accounting certifications to your resume may be just the thing to land you a new position or promotion to advance your career. Further, the market shows that only 36% of accounting professionals are satisfied with their job. This means an increased number of accounting professionals are on the job hunt – which means more competition.

But with an overwhelming amount of accounting certifications to choose from – how do you know which is right for you? First, you’ll need to assess where you are in your career and where you want to go. Take the time to narrow in on the desired industry you want to practice accounting in, what position you will be targeting next, long-term career goals, and the budget you have to pursue a certification.

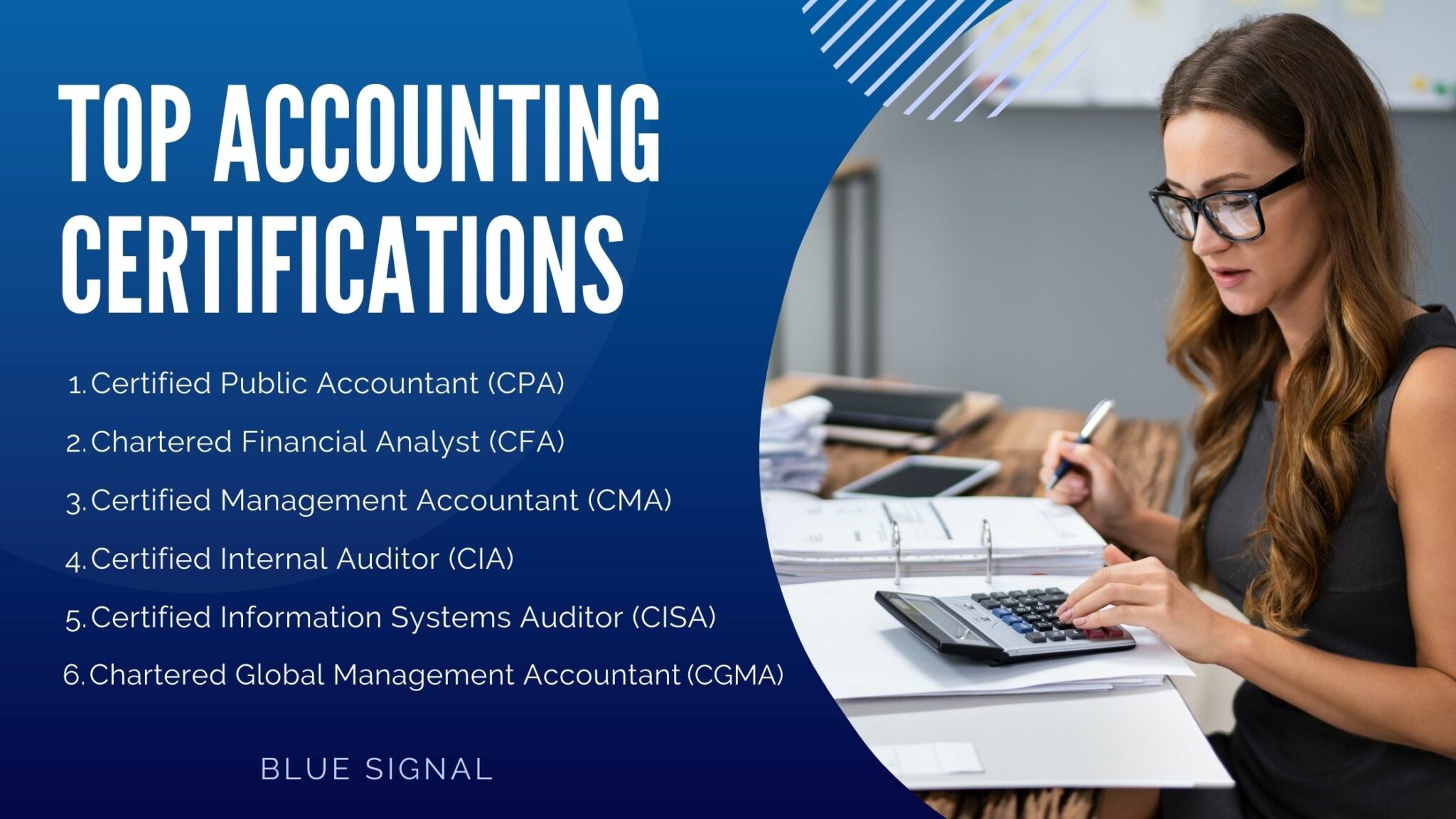

Once you’ve mapped out your situation, the selection process will become much less daunting and the right certification for you will be clear. To get started, check out these top six accounting certifications that will get you noticed in your current role or set you up for success in your upcoming job search.

Top 6 Accounting Certifications

#1 Certified Public Accountant (CPA)

A Certified Public Accountant is defined as a trusted financial advisor who helps individuals, businesses, and other organizations plan and reach their financial goals. According to a recent study, 52.7% of accountants in the US are CPAs. It has also been noted that this certification is the most in-demand credential, even above an MBA. Obtaining a CPA license gives accountants the right to practice public accounting within their state.

CPA Certification Process:

The licensure process to becoming a CPA follow the 3 E’s – education; exam or uniform CPA examination; and experience. The requirements for education will vary by state/jurisdiction but all require at least 150 semester hours to complete this step. Next, candidates need to complete the uniform CPA exam which is computer-based and consists of four sections. Those sections include Auditing and Attestation (AUD); Business Environment and Concepts (BEC); Financial Accounting and Reporting (FAR); and Regulation (REG). Question types include multiple choice, simulation, and written communication. Candidates need to receive a passing score of 75 on a 0-99 scale. In regards to experience, many states require the candidate to have 1–2 years of experience under a CPA.

Practicing CPA’s must maintain their accounting certifications through Continuing Professional Education (CPE), which is typically 40 hours per year. Overall, any accountant looking to pursue and/or practice public accounting is required to be licensed as a CPA within their state/jurisdiction.

Price:

Total cost of obtaining a Certified Public Accountant certification is about $3,025.

#2 Chartered Global Management Accountant (CGMA)

The Chartered Global Management Accountant (CGMA) designation is the premier management accounting credential. Through this certification, candidates advance their skills in finance, operations, strategy, and management, helping them to further their accounting career. Overall, this designation was created in 2012 to recognize a unique group of management accountants who have reached the highest benchmark of quality and competence. The CGMA certification is backed by tools, webinars, reports, and research that challenge thinking and keep candidates at the top tier of their profession. It’s even been reported that 91 of the Fortune 100, and 95 of the world’s top 100 brands choose CGMA designation holders over others.

CGMA Certification Process:

Those looking to earn the Chartered Global Management Accountant designation must complete the CGMA Finance Leadership Program. This course is similar in scale and skill as a master’s degree. Overall, the program is set up to be convenient, personalized, and comprehensive, as it offers an intuitive system interface, intriguing content, and progress you can track. The program is divided into three levels – operational level, the management level, and the strategic level. Each of these levels will continue to build on skill and knowledge learned from the previous one. For those who have already received relevant accounting certifications or degrees, may be eligible to skip certain levels, resulting in a faster completion.

Once enrolled in this program, candidates will complete the coursework and case study exams. After working through the Finance Leadership Program coursework, you will need to complete a minimum of three years of practical work experience before applying for the CGMA certification online.

The CGMA Finance Leadership Program really pushed me to think about taking my knowledge one step further beyond just producing accurate financials.”

- Susan Groover, CPA & CGMA holder

Price:

The CGMA Finance Leadership Program is offered in one-, two- or three-year subscriptions. If completing all three levels, the total cost is $6,375. Also, for those who are Certified Public Accountants, there is special pricing available. Once you’ve earned your CGMA designation, there is an annual fee of $395 to maintain it.

#3 Chartered Financial Analyst (CFA)

The Chartered Financial Analyst (CFA) is an advanced charter for those who wish to expand their knowledge and skills. This certification allows candidates to thrive in the highly competitive accounting/finance industry. The CFA charter is designed to enable accountants with a heightened expertise and real-world skills in investment analysis. This designation is for all industry experience levels, from practicing investment professionals, students, or those looking to switch careers all together. Those who hold a CFA charter occupy a range of investment decision-making roles, with the majority of professionals being Research Analysts or Portfolio Managers.

This specific designation brings major value within the evolving industry and truly provides a leg up when it comes to competition. As a globally recognized credential in the investment management profession, the CFA charter shows employers your dedication and skill-level. When presented with a CFA, investment employers take notice in understanding it represents a higher standard.

CFA Certification Process:

To achieve a Chartered Financial Analyst charter, candidates must complete the CFA Program along with acceptable work experience requirements. The CFA Program tests the fundamentals of investment tools, valuing assets, portfolio management, and wealth planning. Overall, this program contains three levels of curriculum, each with its own exam. Each level will build on the prior level and become increasingly more complex as candidates advance. On average, candidates report investing over 300 hours of study in advance to successfully passing each level. Paired with the curriculum, the CFA Institute offers candidates innovative study tips and prep providers with extra exam prep courses and materials to ensure program success.

All three levels of the program focus on knowledge surrounding the same overarching themes, but differ in exam style and format. These levels cover the following ten topic areas, ethical and professional standards; quantitative methods; economics; financial statement analysis; corporate issuers; portfolio management; equity investments; fixed income; derivatives; and alternative investments.

The Level I exam consists of 180 multiple choice questions, split between two 135 minute sessions. Level II exam consists of 22 item sets comprised of vignettes with 88 accompanying multiple-choice questions. Lastly, the Level III exam will then consist of 11 item sets comprised of vignettes with accompanying multiple-choice items and 11 constructed response (essay) questions.

Price:

The total cost for the CFA Program is $3,050 – $3,950, depending on fee deadlines. The CFA Institute also offers scholarships to help make the CFA Program more accessible for all.

#4 Certified Management Accountant (CMA)

The Certified Management Accountant (CMA) certification has been the global benchmark for management accountants and financial professionals for over 50 years. CMAs bring strategic thinking, applied work experience, and the ability to convert data into dialogue. The overall goal of the CMA certification is to give candidates the ability to explain the "why" behind numbers, not just the "what." In turn, this gives those greater credibility, higher earning potential, and ultimately a seat at the leadership table. On average, those who complete the CMA certification receive a 58% increased salary advantage compared to accountants without the certification.

CMA Certification Process:

The CMA certification exam process is taken in two parts, covering 12 competencies. Part one focuses on financial planning, performance, and analytics. These topics include external financial reporting decisions; planning, budgeting, and forecasting; performance management; cost management; internal controls; and technology and analytics. Part two of the exam then focuses on strategic financial management topics that include financial statement analysis; corporate finance; decision analysis; risk management; investment decisions; and professional ethics. Background requirements for the CMA certification include a bachelor's degree or other professional accounting certifications and two years of work experience.

Preparation for the CMA certification can be accomplished either in a live or virtual classroom, both on your own time. Methods and materials are selected on an individual basis to best match the way each candidate studies.

On average it takes about 12-18 months to complete both parts of this certification. It’s recommended to plan on spending about 150-170 hours of study prep, per part. Based on a recent report, candidates on average can expect $1,696 or more in returned lifetime earnings for every hour of study time they complete.

Price:

For professional members, the cost of the CMA certification includes a $280 entrance fee and $460 exam fee (per part), totaling $1,200. For student/academic members, the entrance fee is $210 and each exam fee is $345, totaling $900. The Institute of Management Accountants (IMA) also offer a group staff enrollment program to companies looking to help their employees close the skills gap and gain a competitive edge in the market.

#5 Certified Internal Auditor (CIA)

The Certified Internal Auditor (CIA) designation has been setting the standard for excellence within the auditing space for over 40 years. As the only globally recognized internal audit certification, the CIA designation is the overall best tool to communicate knowledge, skills, and competencies. This certification will ensure candidates can effectively carry out professional responsibilities for any internal audit, anywhere in the world.

Upon completing this certification, auditors will be able to distinguish themselves from their peers as well as enhance credibility and respect, sharpen skills and proficiencies, increase advancement and earning potential, and demonstrate understanding and commitment. With over 170,000 CIAs in 170+ countries awarded the designation; the CIA is proven to be the certification most valued by employers of internal audit professionals.

CIA Certification Process:

To be accepted into the CIA program, the candidate must either, hold a bachelor’s degree or higher; hold an active Internal Audit Practitioner designation; or possess five years of internal auditing experience. This experience can be in any of the following: internal audit, quality assurance, risk management, audit/assessment/disciplines, compliance, external audit, internal control. A character reference signed by a CIA, CGAP, CCSA, CFSA, CRMA, QIAL, or the candidate's supervisor, is also required to apply.

Once candidates have been accepted into the CIA program, they must pass all three CIA exam parts. Part one of the CIA exam is the essentials of internal auditing. It covers six domains focusing on the foundation of internal auditing; independence and objectivity; proficiency and due professional care; quality assurance and improvement programs; governance, risk management, and control; and fraud risk. This section is made up of 125 questions and is 2.5 hours in length.

Part two, the practice of internal auditing, covers four domains focused on managing the internal audit activity, planning and performing the engagement, and communicating engagement results and monitoring progress. Candidates must complete 100 questions within 2 hours.

Lastly, part three is an additional 2 hours and 100 questions on business knowledge for internal auditing. This section reviews four domains focused on business acumen, information security, information technology, and financial management. To prepare, the IIA provides sample CIA exam questions and answers to use as insight into what types of questions to expect.

Price:

Pricing for the Certified Internal Auditor course varies based on membership. The total price including application and all three exam fees for IIA members is $940, non-members is $1,445, and students is $740.

#6 Certified Information Systems Auditor (CISA)

The Certified Information Systems Auditor (CISA) certification is a world-renowned standard of achievement for those who audit, control, monitor, and assess an organization’s information technology and business systems. Overall, the CISA certification proves your expertise in the following domains, information systems auditing process; governance and management; information systems acquisition, development and implementation; information systems operations and business resilience; and protection of information assets.

The average salary of a CISA holder is $149K and acquiring this designation, on average, results in a 22% pay boost and 70% on-the-job performance improvement. With over 151K+ certification holders, the CISA certification is the clear choice for those looking to prove their expertise in IS/IT auditing, control, and security.

CISA Certification Process:

Eligible candidates for the CISA certification must have five or more years of experience in IS/IT audit, control, assurance, or security. The exam is split up into five domains, which include information system auditing process; governance and management of IT; information systems acquisition, development, and implementation; information systems operation and business resilience; and protection of information assets. The total length of the exam is 4 hours and is constructed of 150 multiple choice questions.

ISACA offers a variety of exam preparation resources including group training, self-paced training, and study resources to help ensure exam success. Once candidates take the exam in an approved proctored setting, they will receive their score immediately on the screen after completion. ISACA uses and reports scores on a common scale from 200 to 800. 450 or higher is considered a passing score.

Taking and passing the ISACA certification exam, candidates must submit their application along with a $50 processing fee. All CISAs must adhere to ISACA’s Code of Professional Ethics, Terms of Use, and Privacy Policy, as well as Continuing Professional Education (CPE) Policy, and Information Systems Auditing Standards.

Price:

Exam registration fees for the CISA certification are based on membership status at the time of exam registration. Price for ISACA members is $575, and $760 for non-members.

Accounting Certifications Wrap-up

Regardless of the certification you choose, having an additional designation of expertise on your resume ensures an industry advantage when making career moves, big or small. If you’re feeling overwhelmed with which of these accounting certifications is right for you, take it one step at a time. Narrow down your options based on skill-level, career goals, and budget. Upon completing which ever certification you choose, be sure to stay up to date on their renewal processes and update your resume and LinkedIn profiles to ensure you get the most out of your hard work.

If you’re still not 100% sure which accounting certifications would be best for you, contact a BSS recruiter to help you decide and see which career path makes the most sense!