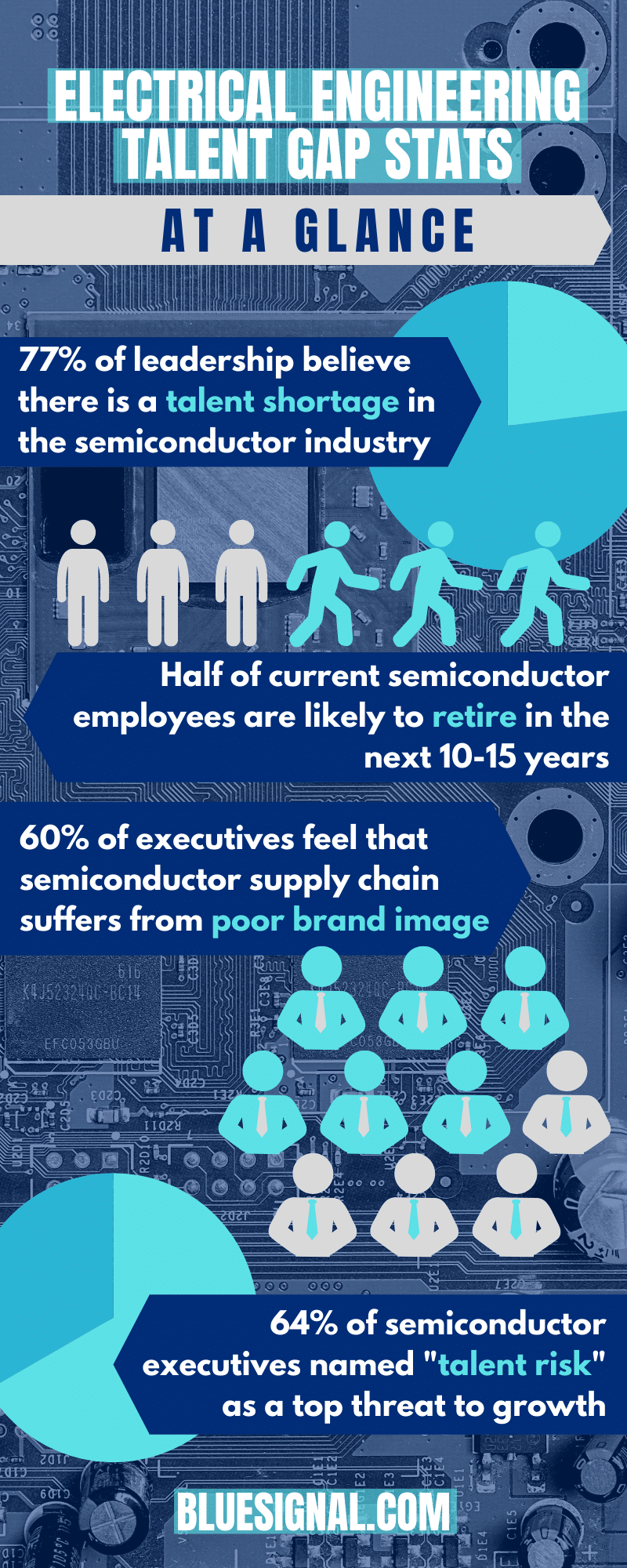

With the 4th Industrial Revolution, there have been expansive job opportunities in emerging technology such as artificial intelligence and data science. Locally, reports show that every 100 tech jobs created in Arizona result in 252 jobs in other sectors. From manufacturing all the way to sales - each job vertical has expanded due to new developments in systems, applications, hardware, and software. However, it seems like much of the allure within these jobs leans more toward high-profile software-oriented companies like Facebook, Apple, Amazon, Netflix, and Google (FAANG). In one survey by Deloitte, over 77% of respondents believed there is currently a talent shortage within the semiconductor industry. Without chip designers, system engineers, and other EE talent, those FAANG companies would not be able to operate. Is this cause for concern? Or is there opportunity within this talent gap?

Issues with the Talent Gap

Last year KPMG found that 64% of semiconductor executives named “talent risk” as one of the top three threats to their organization’s growth. As technologies like IoT, Artificial Intelligence, and 5G evolve and are streamlined, new enhancements need to be invented to support them and remain competitive. The end of Moore’s Law put this need for innovation into an even clearer perspective. Yet, industry leaders are struggling to react to this need through skill development, education utilization, and developing an overall talent strategy. This means,despite growing demand for semiconductor technology and innovation being developed in this space at lightning speeds, industry leaders are still struggling to attract qualified talent and retain their skilled employees.

The number of qualified candidates in the industry today are not meeting the growing need. MRL, a recruiting group, estimates that half of the current semiconductor employees are likely to retire in the next 10 to 15 years - with hardly anyone qualified enough to fill those gaps. With people retiring out, and few newcomers - the talent pool is shrinking. In order to keep up with demand and to stay relevant in the marketplace, semiconductor companies need to establish better plans to address the talent gap.

Part o the problem lies within the marketing of the semiconductor space. Today’s STEM graduates want to be on the cutting edge of technology - and are drawn to the allure of big-name software companies which are constantly covered by the industry, and make a visible impact on people’s lives. On the flip side, the direct impact semiconductors, electrical components, and analog technology have on everyday life is not as well-known. Compared to other tech giants, 59% of respondents in Deloitte’s survey said that the semiconductor industry’s career path was just not as attractive. They also found a high rate of turnover in semiconductor companies, as well as a lack of knowledge on how to apply those highly technical skills to grow their career throughout the industry.

The industry is in need of a recruiting update - with one survey finding that 55% of companies feel unprepared to tackle the issue of attracting larger numbers of young people and graduates. These chip design and electrical engineering-focused companies need to focus on attracting and developing new talent to keep pace with the rest of the tech industries. Particularly, they need to learn how to market to millennials - as they have become the largest demographic group in today’s workforce.

Areas of Opportunity

All of this information seems pretty bleak, however, it leaves some pretty clear action-items on ways to turn this talent gap around. If the semiconductor industry wants to attract more talent, they must work on marketing themselves better to those entering the workforce. If they wish to retain their talent, they need to create more skill development opportunities and establish more career paths.

A key trait of the career-seeking millennial is wanting their work to have a tangible impact on daily life. That’s why they are so drawn to big software companies; it is easy to find people who use those products and services every single day. Competing with this brand familiarity and accessibility is difficult, over 60% of executives surveyed by Deloitte felt that companies in the semiconductor supply chain suffer from poor brand image compared to those other technology companies. Better employer and industry branding could help reverse this. When it comes to marketing to graduates, it must be made clear the exciting and direct impact semiconductors have on everyday life - whether that be through 5G, IoT, automotive, industrial, or consumer applications. By showing the impact, millennials will come to imagine a satisfying and rewarding career within the space.

It doesn’t help that the methods are outdated. From slow hiring processes to uncompetitive salary offers, millennials are not lining up for this old fashioned workplace and recruiting model. One microelectronics researcher stated that, “The jobs waiting for them after graduation are often limited and pay relatively poorly. It is much more appealing for these top engineers to go to big internet companies and create applications and software, rather than spend 5-10 years in a small lab doing extremely difficult and expensive hardware research.” From the outside looking in, they are seeing a lack of support and collaboration within these roles, and are having a hard time envisioning a solid career path within the field. To combat these feelings of disdain, a tech recruiting firm out of Europe suggests increasing recruiting efforts at universities and reevaluating what is offered to employees. Initiating R&D projects with universities, providing more mentorship and trainee programs, and other career development opportunities would help engage internal employees while also giving students an inside look into the job.

As the digital design of systems and applications continually changes, so should the methods by which employers build their roadmaps to keep ahead of the innovation and develop their internal talent. Those within the electrical engineering space today are experiencing some key pain points as well when it comes to entering and staying in the semiconductor vertical. One survey found that 60% of their semicon employees leave their jobs within 3 to 5 years, pointing to an employee retention issue. In addition to regular salary and title evaluations, on-the-job learning, advanced degree training programs, and other career guidance pathways should help retention.

The United States is not alone in this struggle, with the semiconductor talent shortage impacting businesses all across the globe. China and Singapore have been developing talent acquisition and talent retainment strategies in recent years, and we can learn from them. China is taking the homegrown talent pool approach, and looking to strengthen education for graduates, improve the benefits for their current engineers, and support research and development throughout the STEM sector. Meanwhile, Singapore is using strategies backed by Accenture and their own Economic Development Board to bolster the talent pool. This includes collaborating with the government on building out a roadmap and support stream in preparation of Industry 4.0, implementing new routes for cross-functional learning within the tech space, and forming workforce support in the form of unions and business chambers to develop transition paths. All of these efforts help to create long-term solutions that build the talent pipeline for semiconductor jobs now and in the future.

Key Takeaways

It is estimated that the semiconductor industry is the fastest growing electronic component industry in the US. There is significant opportunity there for those that have the knowledge! And, for those who know where to find the talent. Moving forward, retention tactics need to be better emphasized, and marketing efforts better funded. The semiconductor industry has a lot to offer, but has done little in the way of advocating for itself when competing against software and application giants. The good news is, you now have a friend in the business who understands the gap in the market and can help you build your pipeline and strategy to ensure your company comes out on top. Through strategic developments in marketing, education, and recruiting efforts, the semiconductor talent gap can be minimized.

In Blue Signal’s home state of Arizona, the technology sector is growing at a pace 40% faster than the rest of the nation, with a 5% wage growth. Here, the governor plans to budget $12.5 billion to STEM workforce training and education. Arizona is ranked second in the nation for net new tech business establishments - right behind New York City. By tapping into local talent and Arizona college programs, Blue Signal has a unique opportunity to capitalize on this growing job market and talent pool. We understand the challenges and competition out there and have proven ourselves successful in overcoming these obstacles to help find companies educated and experienced professionals in the electrical engineering space. Contact one of our specialized recruiters today to discuss your opportunities for talent acquisition - some of which might be right in your backyard.