The Distributed Antenna Systems (DAS) market has made important gains in the past several years. The United States is the world leader in 4G technology (with 5G in the works), and exploding growth in wireless broadband coverage has led to a big rise in network infrastructure.

The Changing DAS Landscape & Forecast

In-building wireless applications are one of the most important areas of DAS market growth. Tier 1 demand has dropped (this includes stadiums, large office buildings, urban mass transit systems, and other large venues). Tier 2 demand (mid-size venues) will grow steadily over the next five years as retailers and medium office buildings invest in DAS and small cell technology. This growth is due to a high demand for coverage that is never interrupted. Network outages are more expensive than ever, and consumers demand continuous access to data and a good phone signal.

Will DAS/small cells replace macro cells? Not likely—they require 10 times the number of sites to cover the same area as a macrocellular site. Instead, they are a new facet of the new heterogeneous network infrastructure model.

Intense market demand has flooded the industry with small solutions firms hoping to make it big. In the next few years, we can expect this high-innovation environment to stabilize and thin out as the strongest players begin to dominate the space, acquiring and driving out smaller firms as they grow.

The DAS Skills Gap

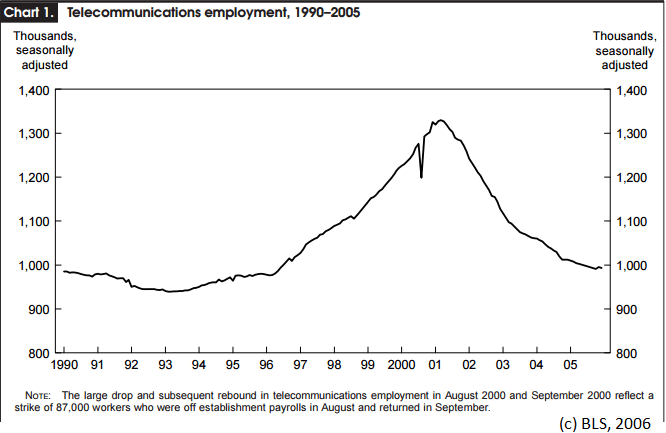

According to the Bureau of Labor Statistics, the number of jobs in the telecom industry has fallen dramatically since 2006, but this statistic does not give the full picture of today’s telecom labor market. The telecom industry experienced a bubble in the 1990s as cell phones gained popularity. Although the total number of jobs has fallen, there is a growing skills gap in technical industries, including the telecom and RF/DAS space.

The economy as a whole is facing one of the biggest skills gaps since the government began collecting data. This also applies to the telecom industry. Companies report major labor shortages within three major areas: technology experts, engineers, and field technicians. Even worse, the Baby Boomers, who dominate positions in senior management, are retiring in large numbers. They leave behind no good source of talent to replace them. This is a good reason to start succession planning early.

Although the millennial generation is one of the most educated workforces in history, telecom companies cite lack of technical experience as one of the biggest hiring challenges they are currently facing. The economy is experiencing high levels of educated workers being unable to find employment, despite the huge demand for skilled labor.

After the 1990s telecom bubble burst in 2000, there was a sharp drop-off in telecom employment. But competition is still intense for top talent, like engineers and technology experts.

How to Secure DAS Talent

Large enterprises are scrambling to implement training programs to grow the next generation of talent. This is the best approach for a long-term plan, but many companies need to capitalize on DAS market demand now. It takes years to train up new recruits.

This “land grab” phase has led to an industry-wide war for talent, which makes it difficult for DAS-focused SMB telecom firms to attract and retain top talent. For these companies, investing in a comprehensive training program is dangerous—it means falling behind the growth curve. Instead, invest in a relationship with a trusted recruiting firm who knows the telecom and wireless space well. In a high-demand, employee-driven market, sourcing and attracting talent is a full-time job. The cost of a bad hire can cripple an entire project during a critical time.

If your company is invested in DAS and small cell projects, contact us for a free comprehensive analysis of your talent sourcing strategy for the next 2 to 5 years. Get in touch with us at info@bluesignal.com, or at (480) 939-3200.