With the Coronavirus pandemic, there have been unprecedented changes in the economy and global marketplace - impacting all industries in unpredictable ways. Amazingly, businesses have adapted to the needs of the market, creating options like curbside pickup, contactless delivery, and much more to satisfy the needs of consumers, but also keep them safe. With medical teams working around the clock to ensure the health and wellness of their communities, there has been an incredible surge in demand for personal protective equipment (PPE) and other protective materials. Even food and beverage companies rose to the challenge, with some global distilleries shifting production from vodka and gin to hand sanitizer. This change in business strategy on all levels of consumption has resulted in an exponential demand in plastics and packaging products.

The Global Flexible Packaging Market is expected to grow by over $50,000M USD by the end of 2025 according to Valuates Reports. Packaging as it pertains to its product marketing value on shelves, all the way to how it plays into logistics and long-distance supply chains, will always remain a key piece in our economy. The industry is vast and supports everything we know about the consumer market, making it essential in all product-oriented businesses. However, a strong debate stands between what comes next for the industry with sustainable vs. health conscious packaging.

Product Design Changes, Historically

For decades, packaging design has gone through several rounds of optimization to better support sustainability, while maintaining convenience and cost-effective product housing. To reinforce sustainable thinking, the industry has deployed design improvements like eliminating unnecessary packaging, increasing the use of recycled content, and helping communicate sustainability narratives like promoting recycling habits in consumers. There has also been efforts toward the increased use of mono-materials as opposed to multilayer packaging, creating higher recyclability of the packaging itself.

Due to consumer preference shifts as the impact of plastics and other materials on the environment have become more apparent, businesses have altered their packaging practices to appeal to the movement. Companies have worked to decrease packaging weight by 20-50%, resulting in less raw material used. Others have eliminated single-use plastics, or have increased the volume of the packaging to sell more product per unit. For some companies, this takes the form of eliminating packaging completely. While each of these avenues create a lesser impact on the environment, they can simultaneously counteract efforts for product preservation and health safety.

Today’s Market Changes

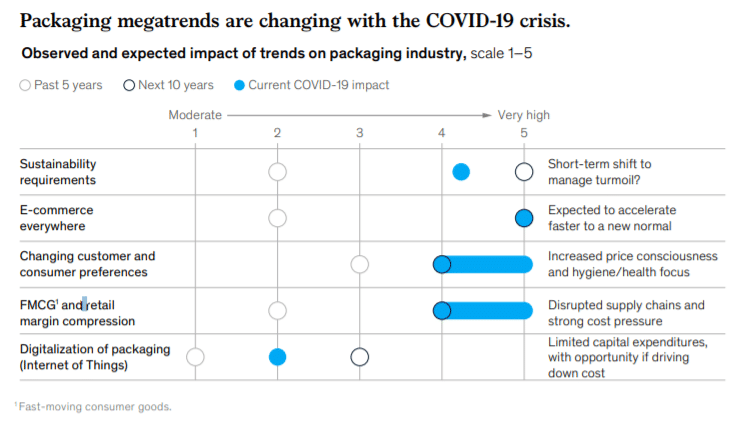

Just as the market has shifted to create better sustainability as environmentalism grew within consumer buying habits, it has also worked to assuage health concerns due to COVID-19. Unfortunately, these two key interests have somewhat contrasting ways of being implemented - with concerns over health and safety creating a “temporarily high demand” of single-use plastic materials and packaging. One Head of Packaging and Design for a UK based company speculated, “As we become increasingly more aware of germs being transmitted through surfaces, will we begin to ask ourselves who else has touched that banana or apple, and will we shun these unwrapped products in favor of the relative safety and security offered by a plastic wrap?”

So far, the market supports this theory with a CAGR of 5%. Due to the increased demand in FMCG and pharmaceutical packaging, and rising e-commerce sales and packaging due to lockdowns/quarantining, the global packaging market is projected to grow from $909B USD to $1,012B USD by 2021.

Due to pandemic lockdown measures alone, the eco-friendly packaging market has shrunk by 0.2% since March 2020. Then, when considering hygiene concerns, reusable packaging demand has not only decreased but been banned in some cases. States like California, Hawaii, and Massachusetts that previously banned single-use plastic bags are now starting to reverse these bans over the perceived health threat of bringing your own bag into stores. But does this represent a long-term market shift? For the near future anyway, it appears as though single-use plastics such as polystyrene and polyethylene, as well as paper and cardboard packaging solutions, are set to experience a boost in demand.

Job Market and Talent Gaps

As a way to navigate the economic turbulence in the packaging industry, companies have started to shift their segments to support more “essential” customers like those in the medical supply, healthcare, sanitation, and personal or home care fields. With the reduction in travel, car sales slowed and GM and Ford Motor Co deployed factories to produce ventilators. Rather than making plastic products for car parts, their assembly line workers began manufacturing PPE. While some of those skillsets are transferable across industries - including automation and engineering - some machine-focused roles might experience a gap in talent.

Whether it be thermoforming, blow molding, extrusion, injection molding, or polymer casting - there are different processes and machines that are used to specialize in each method of plastic manufacturing. Some companies, in reaction to the market’s demand for “safer” product housing, might look to utilize more flexible packaging types and will need to bring on professionals in flexographic printing or extrusion coating. Without having prior involvement in this space, this transition will call for a whole new skillset. This is where Blue Signal comes in.

As recruiters in the plastics and packaging spaces, Blue Signal has the industry insights necessary to understand the competitive landscape, and help you attain the talent you need to stay ahead in this explosive-growth market. With a limited number of tenured professionals in the space, can you afford to wait? Contact us today to discuss your options, and get back to what is most important - providing products that keep our communities safe.