Employee relocations happen for a number of reasons. A company may be opening an office in a new location, or changing offices as part of an acquisition. However, the most common reason is that a company has hired a new employee in another part of the country.

Relocating an employee is a complex and often high-stress process. The logistics and emotions of the move can be difficult for everyone involved. But with some planning and forethought, the process will go smoothly for everyone.

When interviewing a candidate who would require a relocation package, start the discussion early, and keep it separate from salary negotiations. Many hiring managers combine relocation and compensation into one conversation, but this often leads to conflict and bargaining. No matter what the compensation is, the cost of relocation is different for every situation and should be considered separately. Having a recruiter to act as the middle-man is very helpful, since they can manage discussions on both sides to come to a mutual agreement without tensions running high.

Employee Relocation Decision Factors

1. Living situation

The house or apartment is a major consideration in a relocation package. For renters, the process is straightforward. They will need to break their lease and find a comparable apartment in the new area. Homeowners will need to value their house, sell it, and buy a new one, usually all within a short timeframe. It all starts with a comparative market analysis with a realtor. Get MLS data to compare similar homes in the area that have recently sold, and develop a price listing for the home as soon as possible. This will help the house to sell for a fair price.

What to Consider:

- Lease breakage and security deposit coverage for renters

- Realtor fees

- Home selling and home buying services

- Property management to maintain old home while on the market

- Hotels and temporary housing

- Current home equity that may be lost due to housing market difficulties

- Interim housing

- Storage for personal property

- Replacement cost for depreciated items such as old furniture

2. Cost of living

A middle-class lifestyle does not look the same everywhere in the country –Manhattan has a very different cost of living compared to suburban Texas. A relocated employee may find that their spending habits have to undergo many adjustments in a new area.

Not only will there be differences in normal expenses such as car insurance and property tax, they may need to revamp their work wardrobe, buy or get rid of a car, or take on unfamiliar expenses. This can work heavily in favor if an employee is moving to a less expensive area, but it is painful for an employee to start a challenging new job and also keep up with big lifestyle changes at home.

Companies can provide a “Why Our City” packet with highlights of the area and helpful tips for settling in. This small gesture can have a huge influence on a new employee and get them excited for their new home.

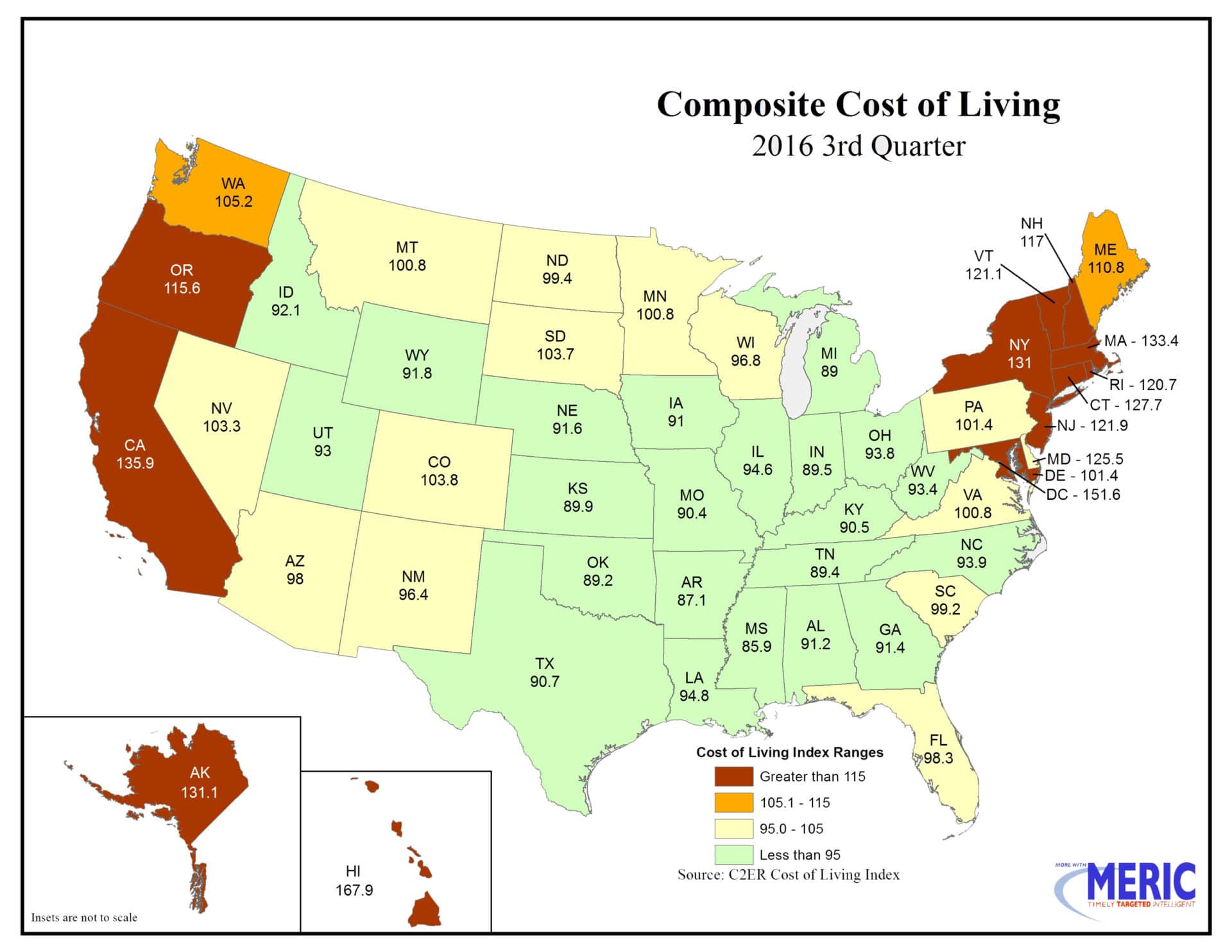

As of 2016, Hawaii, Washington DC, and California had the highest cost of living. Mississippi had the lowest. (Source)

What to Consider:

- Tax rates (income, property, etc.)

- Difference in home values between new and old locations

- Square footage differences, which impact the cost of furnishing and maintaining a home

- Normal day-to-day expenses, such as car insurance, gas prices, and food

- Cost of medical care and health insurance

- Major lifestyle differences (such as keeping a car in an urban area, mass transit costs, wardrobe expectations, etc.)

- Tax liability from receiving the relocation package

3. Family Situation

A relocation usually involves the breadwinner of the family, but most families rely on two incomes. The employee’s spouse will need to make decisions about their employment situation in the new location. Be sure to address with the employee whether other family members would need to secure new employment before accepting the offer. Children are another consideration if they are in school. An employee may choose their housing based on a particular school district or the location of services that their child needs, like athletics, religious organizations, or medical services.

What to Consider:

- Spouse’s lost income and cost of finding a new job

- Children’s educational expenses, travel expenses

- Athletics, programs, religious organizations

- Additional cost of special or medical needs

4. Transportation and moving

Transportation is the final major expense item. This includes more than just the one-way trip to the new location; there is a lot of back and forth during a major move.

What to Consider:

- Plane flights

- Square footage of current house to pack

- Packing, shipping, and unpacking fees

- House-finding trips

- Rental cars (or Uber fees)

- Cost of transporting vehicles (cars, boats, motorcycles, and recreational vehicles)

Types of Employee Relocation Packages

How should a company approach a major relocation to keep their new employee happy? There are three major types of relocation reimbursement packages:

Direct Bill or Third-Party

In this type, the company hires and pays the moving company directly. This type of reimbursement is convenient for the company and the employee for big-ticket items, but it makes it difficult to cover smaller expenses and can lead to a lot of back-and-forth.

A similar type is the third party reimbursement, where a company hires a third party to handle all details of the relocation. This is convenient but expensive. It also may lead to conflict with the employee if the relocation company is inflexible or difficult to work with.

Open-ended

Open-ended reimbursement agreements can be problematic, because there are so many small expenses to consider, like professional cleaners, double rent payments, deposits on cable, utilities, property inspections, realtor fees, etc. These small costs add up fast, and can lead to bickering over details and an unending stream of invoices.

Lump Sum (Capped Reimbursement)

A lump sum reimbursement plan is the simplest way to go, especially for relocations that involve a whole family. A lump sum reimbursement takes into account the major big-ticket items, including the cost of movers, housing expenses, hotel stays, and transportation.

In all cases, the employee should complete a detailed assessment of what their move will cost. Surprises are often expensive and hard to manage in the middle of a big relocation. It pays to plan as much as possible up front, and stay flexible. One major expense that many employees overlook is tax liability. When an employer gives an employee a large sum of money for relocating, the employee may not realize that the government considers it taxable income. The employer should be clear whether or not they will cover this tax liability, or if it is the employee’s responsibility.

Relocation is an opportunity for growth and positive change for an employee. Roll out the red carpet for new employees to make sure that their first impressions of their new home are positive and exciting. In addition, consider the company’s new employee onboarding strategy to make them feel welcome in their new job.

Find more of Blue Signal’s relocation tools here.

Working on an employee relocation within your company? Contact us at info@bluesignal.com for a free consultation.